The global aftermath of the pandemic and the resultant economic instability persist, amplifying financial strain for countless Americans. Daily, the ranks of those grappling with economic adversity swell. In attempts to navigate the challenges posed by the prevailing circumstances, eateries shutter, newspapers cease publication, and businesses undergo liquidation. Consequently, the U.S. unemployment rate has fluctuated within the range of 5 to 7% over the past 18 months, prompting a surge of individuals to seek aid from unemployment offices nationwide. Given the gravity of current circumstances, the significance of the government’s unemployment benefits program has surged to unprecedented levels. Here’s a comprehensive guide to navigate this critical resource.

What Is Unemployment Compensation?

Government-administered unemployment compensation assists American citizens who have recently become jobless through circumstances beyond their control. Its purpose is to offer temporary financial aid to individuals who have lost their employment due to specific factors, such as company restructuring, downsizing, cessation of operations, and more recently, layoffs attributable to COVID-19.

Originating as a response to widespread job loss during the Great Depression, the program was initially enacted into law in 1932. It transitioned into a collaborative effort between federal and state governments in 1935, during President Roosevelt’s tenure.

Although the operational procedures of unemployment assistance have evolved over time, its fundamental objective remains constant: to furnish financial assistance to newly unemployed individuals during their job search endeavors. Nevertheless, certain eligibility criteria must be met before applicants can qualify for benefits.

Who Is Eligible for Unemployment Benefits?

Every state in the U.S. operates its own unemployment agency, resulting in slight variations in eligibility criteria depending on your state of residence. Nonetheless, several general guidelines apply uniformly across all states.

You Have to Be Unemployed Through No Fault of Your Own

This means that your job loss must have occurred due to circumstances beyond your control and without any fault of your own. This might include scenarios such as being placed on furlough, the cessation of operations, or downsizing.

The unemployment office will assess whether your job loss was a result of external factors. Conversely, voluntarily quitting your job or being terminated for misconduct will likely render you ineligible for unemployment benefits. This is why some companies may offer the option to “resign gracefully” instead of termination. Opting to resign under such circumstances would typically disqualify you from receiving unemployment benefits.

You Must Meet the Work Time and Wages Requirement

To be eligible for unemployment benefits, you must satisfy your state’s criteria regarding the minimum wage earned or time worked within a defined period, commonly referred to as the base period. Typically, the base period comprises the last four of the previous five calendar quarters before the filing of your unemployment claim.

Meeting a specific threshold of wages earned or hours worked during this period should qualify you for unemployment benefits.

You Must Be Able to Work and Actively Seeking Employment

The unemployment benefits program is intended as temporary assistance, meaning there’s a finite duration to your benefits—they won’t continue indefinitely. Therefore, active job hunting is necessary to continue receiving compensation.

Even while receiving benefits, regular reporting to your local unemployment office is mandatory. You must demonstrate your fitness for work and provide evidence of ongoing efforts to secure new job opportunities through active applications and job searches.

How Does the Unemployment Benefits Program Work?

The unemployment program operates as a collaboration between the federal and state governments. It’s federally mandated and overseen by the Department of Labor, with state-level administration through local unemployment offices. States act as intermediaries for the federal government in this program, with each state having the flexibility to establish its own guidelines within federal regulations.

Unemployment benefits are financed by taxes levied on both employees and businesses. These taxes contribute to the Federal Unemployment Insurance Trust Fund, which serves to reimburse states for their unemployment compensation expenditures submitted to the Department of Labor. Additionally, states have the option to borrow from federal reserves if their own reserves are depleted.

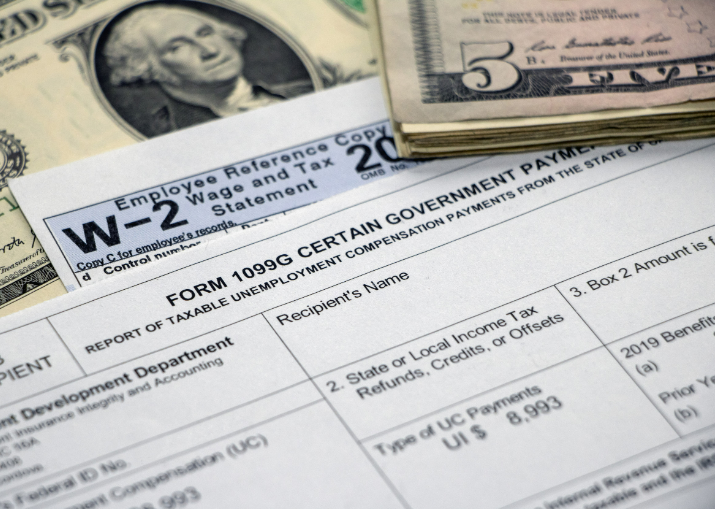

Is Unemployment Compensation Taxable?

According to federal law, all unemployment compensation is considered taxable income and must be reported on your tax return. However, you have the option to withhold tax payments from your unemployment checks. Nevertheless, opting out of withholding taxes could lead to a substantial tax bill upon filing your return. The amount you owe depends on your total annual income, as well as any deductions or credits you may qualify for.

For instance, if you secure a new, higher-paying job before the end of the calendar year, your tax rate might increase. The unemployment payments you received, on which you didn’t pay taxes, are now included in your overall income. It’s crucial to always remember that unemployment benefits are taxable, so it’s wise to budget accordingly.

Duration of Unemployment Compensation

The duration of eligibility for unemployment compensation varies by state in the United States. Typically, most states provide 26 weeks of benefit payments, though some offer less and a few, like Montana, offer more.

The total value of your benefits largely depends on the cost of living and the unemployment rate in your state. Since the compensation aims to replace lost wages, the exact amount you receive also hinges on your previous salary.

Amount of Unemployment Benefits

In most states, unemployment benefits typically amount to about half of what you were earning during your base period. However, some states impose an upper limit on benefits. If 50 percent of your previous salary surpasses this limit, your benefits may be reduced to comply with state regulations. Additional benefits might be available to individuals with dependents, depending on state laws.

It’s important to consider that external income can also impact the amount of benefits received. Additionally, once you secure new employment, your benefits will cease regardless of the remaining time on your benefits plan.

Effects of COVID-19 on the Unemployment Benefits Program

The U.S. unemployment rate skyrocketed from 4.4 percent to 14.7 percent, triggered by the loss of 20 million jobs nationwide. In response to this crisis and the surge in unemployment claims, Congress enacted the Coronavirus Aid, Relief, and Economic Security Act (CARES). Among its provisions aimed at aiding unemployed individuals is the Emergency Unemployment Compensation program. This initiative prolongs benefit periods by 13 weeks, allowing most Americans to access unemployment benefits for up to 39 weeks, surpassing the usual 26-week duration.

How to File for Unemployment

The optimal window for filing unemployment benefits is within one week of losing your job. You can initiate the application process by reaching out to your state’s Department of Labor Unemployment Office.

To establish eligibility, you’ll be required to furnish your social security card, proof of residency, and documentation detailing your employment history for the past 18 months. Additionally, ensure you provide accurate and current contact information for yourself and your former employers. Accuracy and validity in your application information are crucial to preventing delays or potential denials of your claim.

Getting Approval

Upon application, most states typically conduct a brief interview to review your documentation. Subsequently, there’s a verification phase where the unemployment office contacts your former employer to authenticate the information provided. This process can span anywhere from a few weeks to a month.

Following approval of your application, most states mandate a seven-day waiting period before benefit payments commence. Once payments begin, you’re required to report to the unemployment office weekly. During these reports, you must confirm your readiness for work and actively demonstrate your efforts in seeking employment opportunities to continue receiving weekly benefits. If you’re unfit for work due to injury or health concerns, you should pursue short- or long-term disability benefits instead of unemployment benefits.

In Conclusion

Unemployment benefits hold immense significance, particularly against the backdrop of the current economic climate in the United States. Over the past year and a half, the pandemic has spurred an unprecedented surge in unemployment claims. For numerous individuals thrust into sudden joblessness, these benefits became a vital lifeline, ensuring financial stability amid the pandemic’s upheaval. Fortunately, the program persists in fulfilling its original intent, established over seven decades ago: to provide essential support, buffering hard-working Americans against the challenges of unemployment.