All You Need to Know about Credit Scores

Your credit score holds significant importance, as it consolidates various aspects of your financial activity—such as debt levels, credit limits, loan history, credit card usage, and utility payments—into a single three-digit number. This score influences numerous aspects of your life, even those you might not realize.

Primarily, your credit score impacts the cost of borrowing money. For instance, it affects the interest rates you receive when financing a new car or applying for a mortgage. Furthermore, it dictates the interest rates on your credit cards or personal loans. Additionally, your credit score might influence your ability to secure employment or lease a new residence.

Given the wide-ranging influence of credit scores, it’s natural to have further inquiries. Where do credit scores originate? Who determines their calculation methods? And perhaps most importantly, are they equitable?

What is a Credit Score?

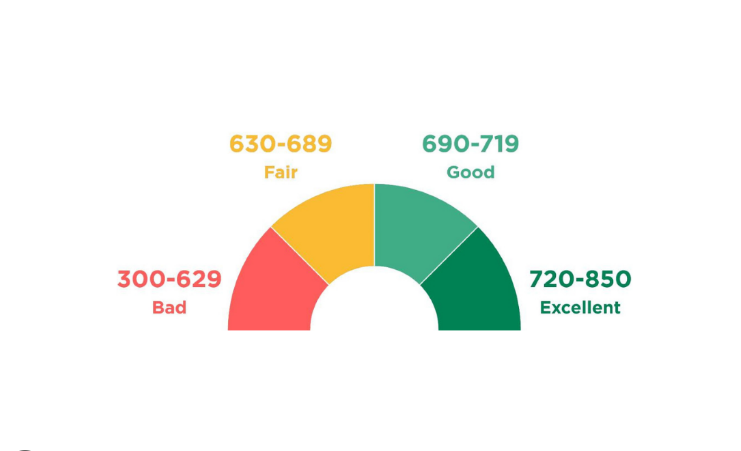

In its simplest form, a credit score is a three-digit number ranging from 350 to 850 (or occasionally 900). The lower the number, the poorer your credit standing. Scores below 580 are generally considered poor, while those between 580 and 740 are deemed fair or good. Scores exceeding 740 are categorized as very good, and anything surpassing 800 is considered excellent.

These numerical values provide a straightforward means of assessing your creditworthiness. Essentially, lenders utilize this number to gauge whether lending you money presents a favorable or unfavorable risk. In essence, it’s an informed estimate of your likelihood to make timely payments or default on debt obligations.

Credit Score vs. Credit Report

While your credit score is essentially a numerical representation, your credit report offers a far more comprehensive overview. It encompasses all the intricate data that contributes to your credit score. This includes your historical credit utilization, encompassing previous loans or credit cards that have been paid off and closed. Additionally, details regarding your mortgage and other public records are often included.

Your credit report also highlights any potential red flags that may have arisen. This encompasses late payments or debts that have been sent to collections. Moreover, it provides a record of instances where your credit was accessed through inquiries. Credit inquiries are standard procedures for various financial activities, such as loan, mortgage, or credit card applications. Furthermore, landlords and certain employers may review your credit history prior to approving you as a tenant or employee.

Who Determines Your Credit Score

In the United States, there are three primary credit bureaus, alongside several smaller ones. These major bureaus include TransUnion, Experian, and Equifax. They are private entities responsible for assessing the information within your credit report to generate your FICO score. (FICO stands for Fair Isaac Corporation, which played a pivotal role in developing the concept of credit scoring.)

Although each of the three major credit bureaus calculates your FICO credit score, there may be slight discrepancies among them due to variations in their scoring algorithms. However, these differences are typically minor and unlikely to have a significant impact. The only exception would arise if a particular creditor fails to report information to one or more of these bureaus, leading to variations in the credit data used for score calculation.

How Credit Scores Are Calculated

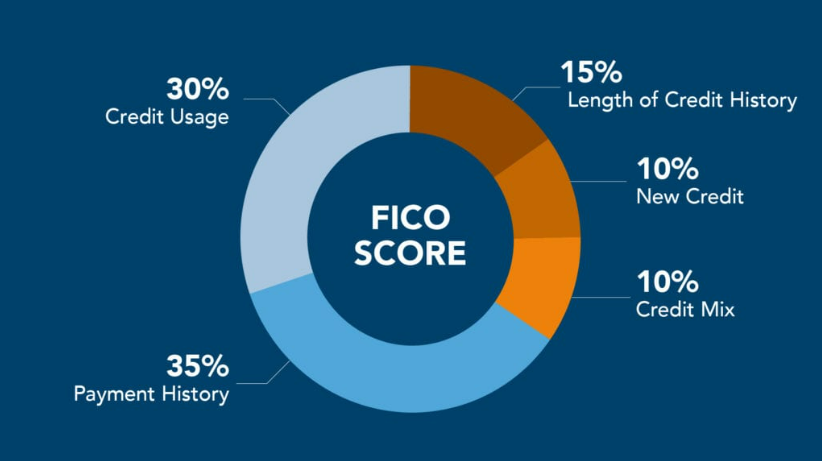

While each credit bureau may use slightly different methods to calculate your score, there are some key factors to be aware of. Your payment history, encompassing both on-time and late payments, constitutes 35% of your score. Consistently making late payments can significantly impact your score negatively, whereas a history of timely payments can greatly benefit it.

Thirty percent of your score is determined by your credit utilization, which refers to how much you owe on loans, lines of credit, or credit cards. Maxing out your credit cards regularly can lower your score.

Other components of your credit score include the length of your credit history (15%), the diversity of credit types you have (10%), and recent credit activity (10%).

Although these factors can vary, managing your credit responsibly primarily involves avoiding excessive debt and ensuring timely payment of all bills, including at least the minimum payments on credit cards or lines of credit.

Who Created Credit Scores?

The origins of credit scores are somewhat obscure. The modern FICO score as we know it today wasn’t fully developed and implemented until 1989. However, the Fair Isaac Company, which introduced the concept of credit scoring, has its roots dating back to the 1950s. Over the years, various factors have been incorporated into the scoring algorithm, with significant updates occurring, such as in 2014 when rent payments were included, and medical debt was given less weight.

Even before the establishment of Fair Isaac, the notion of creditworthiness existed. As early as 1912, retailers maintained their own records to identify customers more likely to repay debts. Eventually, they began sharing this information among themselves, forming the earliest informal credit rating databases. However, as we’ll delve into shortly, these ratings were often highly subjective or discriminatory in nature.

Are Credit Scores Bias or Discriminatory?

Early credit ratings weren’t solely based on financial data; they often included details about an individual’s social, political, or even personal life. This encompassed factors like race, gender, political affiliation, disabilities, or sexual orientation. Consequently, minorities or marginalized groups, regardless of their financial responsibility, faced discrimination. Many anecdotes exist of individuals being denied loans solely due to these non-financial factors.

While modern credit scores are meant to be free from such discriminatory factors, critics argue that biases still persist. Poor credit can lead to higher borrowing costs, trapping certain demographics in cycles of debt. Moreover, credit scores are sometimes used in non-financial contexts, such as hiring decisions or rental applications, further perpetuating systemic inequalities. This system often hinders individuals from improving their circumstances, as they have little control over this arbitrary number.

Fixing the Bias

The government has made efforts to promote fairness in credit scoring over the years. In 1970, the Fair Credit Reporting Act was passed, which prohibited credit bureaus from including personal identifying information in credit reports. This legislation also enhanced transparency, allowing consumers to review and dispute details on their reports.

Under the Fair Credit Reporting Act, debts are required to be removed from credit reports after a specified number of years. For instance, bankruptcy typically remains on a credit report for seven years.

However, credit scores aren’t the sole determinant for loan approvals, credit card applications, mortgages, job opportunities, or rental approvals. Experts estimate that credit scores only contribute to about 20% to 40% of these decisions. Other factors, such as income, age, and even ZIP code, also play a significant role. Additionally, in-person interactions may involve subconscious biases related to appearance or accent, although banks typically don’t openly acknowledge this.

The Future of Credit Scores

Credit scores remain a crucial aspect of financial transactions, as nearly every entity offering credit relies on them for evaluation. However, there’s a positive trend emerging where some companies are diminishing the sole reliance on credit scores. Instead of outright rejection based on a low score, there’s a growing inclination to consider the circumstances surrounding the score. If valid reasons exist, individuals may still qualify for credit.

Moreover, lenders are developing their own assessment models, which are often proprietary. This means that the specific reasons for approval or denial may not always be transparent. While credit scores are likely to persist as a significant component of financial decisions, there’s a gradual shift away from them being the sole determining factor.

How to Get Your Own Credit Score (and Report)

Obtaining your credit score is straightforward. You have a legal right to one free copy annually from each of the three major credit bureaus. Additionally, your credit card or bank account may offer access to additional reports. Visit AnnualCreditReport.com or dial 1-877-322-8228 to request yours.

If you spot an error or have a dispute, each bureau provides channels for correction. You might also receive extra reports if credit is denied. Importantly, requesting your own report does NOT impact your score. Despite a common misconception, self-checking has no negative effect, unlike multiple inquiries by creditors within a short timeframe.

In Conclusion

Navigating credit scores can be frustrating. It takes time to build a good score, yet it can plummet due to one misstep. Despite this, your credit score remains crucial for various financial endeavors like purchasing a car, applying for loans, or getting a mortgage.

Although credit scores have faced criticism for their discriminatory nature, improvements are evident. They no longer include identifying details, and some lenders are reconsidering their significance. Nonetheless, monitoring your credit score is vital. Regularly reviewing your report ensures accuracy and prevents unpleasant surprises when seeking credit.